- Sift Stack

- Posts

- The Weekly Sift Stack: 11.24.2025 - Oracle's Big Bet, Bitcoin's Big Drop, The Fed's Big Question, and Wicked's Big Weekend

The Weekly Sift Stack: 11.24.2025 - Oracle's Big Bet, Bitcoin's Big Drop, The Fed's Big Question, and Wicked's Big Weekend

Summary: Welcome back to the Weekly Sift Stack, where Tyler Sherven and CJ Gettelfinger break down the biggest stories moving the markets.

This material is for educational purposes only and is not intended to provide specific investment advice or recommendations. Investing involves risk, including loss of principal. Any forward-looking statements or expectations regarding company earnings are based on publicly available analyst estimates and are not predictions or guarantees of future performance.

Index Tracker Year To Date: 11/21/2025 Market Close

S&P 500 TR: 13.56%

NASDAQ: 15.34%

Russell 2000 TR: 7.5%

MSCI International EAFE TR: 22.99%

Bloomberg US Aggregate Bond Index: 7.05%

10-Year Treasury Yield: 4.042%

30-year Mortgage Rate: 6.26%

Gold: 56.1%

Bitcoin: (11.05)%

US Dollar Index: (7.66)%

Core Inflation 9.30.2025:

Year Over Year: 3.0%

Month Over Month: 0.2%

Consumer Price Index 9.30.2025:

Year Over Year: 3.0%

Month Over Month: 0.3%

Index Tracker Notes:

Bitcoin dropped 12.1% last week, erasing nearly $800 billion in value since its October peak, wiping out all of its gains for 2025. What is driving the rout? A double whammy of macro nerves and market rotation. Wall Street is sweating a bit over the supposed AI bubble, when tech gets shaky, Bitcoin usually gets punched in the face first. Add in Fed uncertainty, investors shift away from the juicy assets to the more defensive. When we zoom out, Bitcoin corrections of 20%+ happen regularly during bull runs, and they have largely been temporary headwinds, not trend-breakers.

In other index news from the previous week - we see the S&P 500 down about 1.9% with the NASDAQ dropping roughly 2.7% for its third straight negative week, while the Bloomberg US Aggregate Bond Index stayed steady - up about 0.45% as investors became more optimistic about a December rate cut, and the US Dollar Index had one of its best weeks with nearly 1% growth.

Stock of the Week

Oracle (ORCL)

Oracle (ORCL) has suddenly become one of the loudest names in tech, right up there with the usual AI headliners, despite being a 47-year-old enterprise software giant that most people associate with old-school databases. But the funny part? A lot of investors can feel the momentum and still couldn’t explain what Oracle actually does beyond “something with cloud.” So let’s break it down.

Oracle earns its revenue by building and selling database software, enterprise applications, and cloud computing services, business lines that have quietly kept it embedded inside governments, Fortune 500 companies, and massive global industries for decades. Over the past few years, Oracle has pushed aggressively into cloud and AI infrastructure, positioning itself as a late-cycle disruptor aiming to ride the AI wave into 2026 and beyond. With headquarters now shifting to Nashville, Tennessee, the company is signaling it wants to play in the same big-league zip codes as its tech peers.

But here’s where the story gets messy: the debt. Oracle currently carries about $105 billion in debt, with another $38 billion expected by month-end, $23B toward a Texas data center and $15B toward a massive Wisconsin build-out, pushing total debt above $150 billion. To put that in perspective, Nvidia’s debt-to-equity sits around 11%, Meta sits at 26%, and Oracle is running at 436%, with forecasts suggesting it could touch 500% by the end of November. This Debt to Equity ratio compares a company’s total liabilities to its total shareholder’s equity, revealing how much debt is used to finance its assets. A higher ratio indicates that a company relies more on borrowing, which can signal higher risk, while a lower ratio suggests more funding comes from equity, indicating less dependence on debt.

The market, however, went wild after Oracle’s September 10 earnings release, sending the stock up 40% in a single day, its biggest jump in 30 years. Why? Contracted revenue exploded to $455 billion, up 359% year-over-year, nearly triple what Wall Street expected. But this massive backlog comes with massive requirements - Oracle will need dozens of new data centers, unprecedented levels of power, and a torrent of GPUs to deliver on those contracts. Free cash flow has already flipped negative, Capital Expenditure is expected to hit $35 billion in FY2026, and if spending continues at this pace, Oracle’s total debt could reach $300 billion by 2028, almost doubling Ford’s current #1 spot.

So how big is Oracle’s cloud business really? Among the four major clouds - Amazon, Microsoft, Google, and Oracle - the market shares clock in at 32%, 23%, 12%, and 3%, respectively. Oracle is undeniably part of the conversation, but it’s playing catch-up as the smallest of the big four by a significant margin. We often hear the term “cloud company” but what exactly is it? It is a business that provides computing services over the internet (the cloud) instead of through physical hardware you own. Think of it like renting powerful computers, storage, software, or infrastructure from someone. Traditional computing is like owning your own kitchen, but cloud computing is like Door Dash or eating out, you don’t own the equipment, just accessing the service.

So why is this stock still up 20% this year. One word: OpenAI. Of the $455B in contracted revenue, $317B is tied to OpenAI alone. Big Tech’s OpenAI partnerships have sparked enormous market enthusiasm, and Oracle’s deep integration has made it one of the most direct beneficiaries. But as much as the market loves that narrative, there’s a looming question: can OpenAI actually afford all these commitments? The obligations are massive, and the uncertainty is real.

Key Facts

CEO: Clay Magouyrk & Mike Sicilia

Founded June 16th, 1977 by Larry Ellison, Bob Miner, and Ed Oates

Market Cap: $642.94 Billion

Sector: Technology, Software - Infrastructure

52-week range: $118.86 - $345.72

Morningstar Economic Moat Rating: Wide

PE Ratio: 53.62

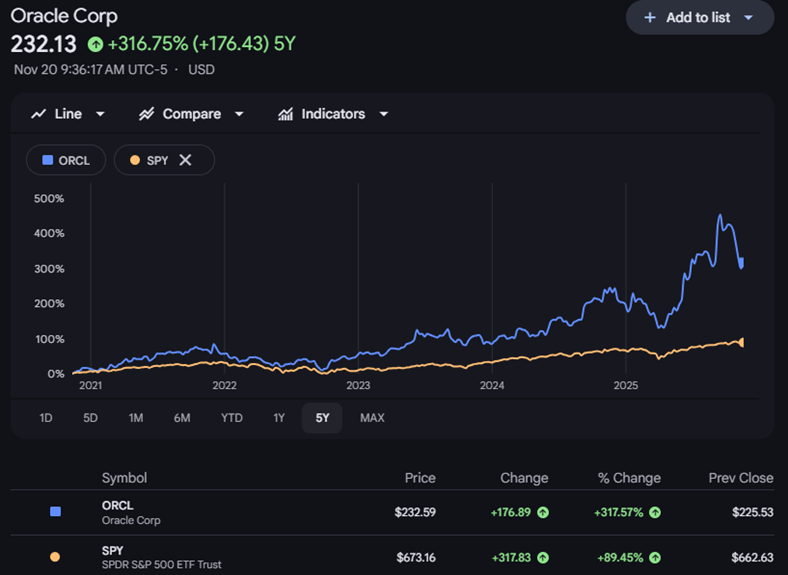

Graph of Oracle Corp (ORCL) vs SPDR Shares S&P 500 ETF (SPY) over the past 5-years

Sources: Google Finance & Morningstar

Weekly Insight

NVIDIA (NVDA) Earnings - “Wall Street’s National Holiday”

Wall Street treated NVIDIA earnings like a national holiday and CEO, Jensen Huang, did not disappoint - analysts cleared their calendars, traders hovered over every line of the release, and the company delivered. Revenue passed expectations, margins expanded, and guidance signaled that AI infrastructure spending is still in its early stages. The demand for GPUs have yet to show signs of cooling, and NVIDIA remains the supplier powering the AI ecosystem.

Eli Lilly (LLY) - “The Pharma Giant Worth a Trillion (Yes With a T)”

History was made again this week as the first trillion-dollar pharma giant has arrived, now up there with Elon Musk’s potential $1 trillion compensation package and a milestone typically reserved for big tech.

What fueled the company’s growth? Weight-loss demand is exploding, reshaping healthcare, reshaping consumer, and reshaping the stock market. Two GLP-1 drugs are leading the way for the company, weight loss injection drug Zepbound and diabetes drug Mounjaro, have led their respective markets.

What exactly is a GLP-1 drug? It is a medicine that works like a natural hormone in your body to help you feel full longer, which can help you eat less food. It also helps with blood sugar control. Think of it as a “fullness signal” for your brain and stomach, and a “helper” for your body’s sugar-regulating system.

Wicked: Part Two - “Broadway’s Blockbuster Returns”

Wicked: Part Two delivered a weekend Hollywood desperately needed, pulling in $150 million across the United States, the 2nd biggest opening weekend of 2025 and a record for a Broadway adaptation. Families showed up in droves, nostalgia kicked in, and the franchise proved it still has cultural gravity. In a year full of box office uncertainty, Wicked stood up, sang high-c, and loud and proud said “Theater kids still run this town!”

The Fed – “Flying Blind into December”

In peak 2025 fashion, the Bureau of Labor Statistics canceled the October Consumer Price Index release due to the government shutdown, leaving the Federal Reserve without its most important inflation data point ahead of the Federal Open Market Committee meeting. NY Fed president, John Williams, added fuel to the speculation, saying there is “room for adjustments”, which is Fed-speak for: we are not done cutting yet. According to CME FedWatch, following Williams’ comments, the market priced in 73% odds of a December rate cut, up from 42% last week. The markets may not love uncertainty, but that word “cut” is like their first love that they just can’t let go.

Did You Know?

Sift Stack Flashback: “The Day the Dow Hit 30,000”

Did you know it took the Dow over a century to reach 10,000 (in 1999), but only 21 years to triple that level. The pace underscored just how fast markets can move when innovation, capital, and policy align. Still, many analysts warned that valuations were stretching, and that the rally might have sprinted ahead of fundamentals.

Poll Question

Will the Federal Reserve cut rates on December 10th? |

Last week’s poll results - What should the government do with the projected $300 billion in 2025 tariff revenue?

67% Voted - Use it to cut the deficit

22% Voted - Send the checks out to stimulate the economy

11% Voted - Invest it into AI, infrastructure, and defense

0% Voted - Political theater, nothing meaningful happens

Quote Of The Week

“Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the only way to do great work is to love what you do.”

-Oracle Founder, Larry Ellison

Feel free send feedback or further input on the poll question to [email protected] or [email protected]. We would love to hear from you!