- Sift Stack

- Posts

- The Weekly Sift Stack: 11.17.2025 Rate-Cut Jitters, AI's Power Core, and The Last Penny Minted

The Weekly Sift Stack: 11.17.2025 Rate-Cut Jitters, AI's Power Core, and The Last Penny Minted

Summary: Welcome back to the Weekly Sift Stack, where Tyler Sherven and CJ Gettelfinger break down the biggest stories moving the markets.

This material is for educational purposes only and is not intended to provide specific investment advice or recommendations. Investing involves risk, including loss of principal. Any forward-looking statements or expectations regarding company earnings are based on publicly available analyst estimates and are not predictions or guarantees of future performance.

Index Tracker Year To Date: 11/14/2025 Market Close

S&P 500 TR: 15.77%

NASDAQ: 18.59%

Russell 2000 TR: 8.32%

MSCI International EAFE TR: 27.73%

Bloomberg US Aggregate Bond Index: 6.57%

10-Year Treasury Yield: 4.144%

30-year Mortgage Rate: 6.24%

Gold: 56.03%

Bitcoin 1.71%

US Dollar Index: (8.5)%

Core Inflation 9.30.2025:

Year Over Year: 3.0%

Month Over Month: 0.2%

Consumer Price Index 9.30.2025:

Year Over Year: 3.0%

Month Over Month: 0.3%

Index Tracker Notes:

The Bloomberg US Aggregate Bond Index saw a slight decline last week with increased unease at the possibility of a 25 basis point rate cut at the Fed’s December meeting. This has led to increasing yields in the bond market over the past week. What looked like a “done deal” is now a penny flip, with the markets slashing December rate-cut odds from roughly 80%+ to about 50%, per Fed Funds Futures. (Source: Yahoo Finance)

Bitcoin also fell over 6% during the previous week in light of more hawkish Fed talk. We typically see Bitcoin or other crypto assets having a more negative response to bad news than the prevailing market.

Stock of the Week

Nvidia Corp (NVDA)

Nvidia (NVDA) has been the talk of the world ever since that little thing called AI started dominating headlines. And no, we’re not talking about Allen Iverson crossover highlights. The funny part? Many people can feel the hype, but still couldn’t clearly explain what Nvidia does or what a semiconductor or GPU even is. So let’s break it down. Nvidia designs and produces GPUs (Graphics Processing Units), which originally surged in popularity because of gaming PCs that needed extreme processing power. Fast-forward to today, and that same high-performance hardware sits at the heart of modern artificial intelligence, from training massive language models to powering real-time AI computation.

Nvidia is positioned as the global leader in AI-grade chips, largely due to its performance advantage and the ecosystem lock-in created by CUDA, Nvidia’s proprietary AI training environment. This gives the company not just a wide hardware moat, but also software switching-cost moat, making it extremely difficult for developers and enterprises to leave. To briefly touch on what moat means, it is a company’s sustainable competitive advantage, the unique strength that protects it from competitors over the long term. Think of it like the moat around a castle: it makes the business harder to attack, copy or replace. Moats can come from things like brand power, pricing ability, proprietary technology, scale, switching costs, or regulation.

The demand behind AI infrastructure is enormous. The Magnificent 7 alone are expected to spend $405 billion on AI capital expenditures in 2025, with estimates showing AI infrastructure spending climbing toward $2 trillion annually by 2030. More on the Magnificent 7, this includes the 7 biggest companies in the S&P 500 that have been leading stock market growth the past 5 years. Think Apple, Microsoft, Google, and of course - Nvidia.

However, no investment story is without risk, Nvidia’s biggest customers are also its biggest potential competitors. Tech giants are steadily developing in-house chips in hopes of lowering dependency and cutting long-term costs. With earnings expected after the bell on November 19, all eyes will be on three core metrics: EPS performance vs. aggressive expectations, data-center revenue growth (the real AI profit engine), and gross margins, which will validate Nvidia’s pricing power and moat durability. And of course, demand signals for Blackwell chips, which reportedly can maintain performance relevance for five to six years, could be a key narrative mover.

Key Facts

CEO: Jensen Huang

Founded April 5th, 1993

Market Cap: $4.62 Trillion

Sector: Technology, Semiconductors

52-week range: $479.80-$796.25

Morningstar Economic Moat Rating: Wide

PE Ratio: 54.11

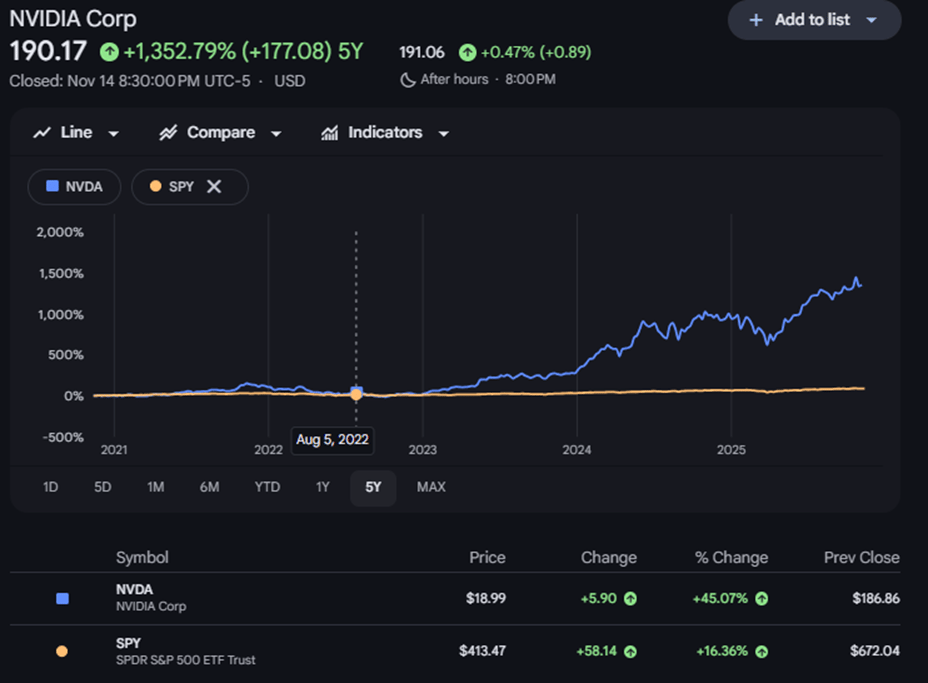

Graph of Nvidia Corp (NVDA) vs SPDR Shares S&P 500 ETF (SPY) over the past 5-years

Sources Google Finance & Morningstar

Weekly Insight

Government Shutdown - “The Longest Coffee Break in Washington”

Congress finally reached a deal and sent a funding bill to President Trump, who signed it, reopening the government after 43 days. But the work isn’t done: many agencies are still scrambling to restart, and the healthcare fight that helped trigger the shutdown may fuel future impasses. Markets breathed a sigh of relief, but the mess exposed how easily policy paralysis can grind America’s gears.

Pennies - “The Coin That Costs More Than It’s Worth”

The U.S. penny is the fiscal equivalent of keeping that T-shirt you never wear: sentimental, pointless, and costing you money. It costs more than a penny to make a penny, and most of them go straight from cash registers into jars and never reappear. The story of the copper coin ended on November 12th with its last minting in Philadelphia.

Michael Burry - “The Perma-Alarm Bell of Wall Street”

Michael Burry is back with another warning, because of course he is. Famous for calling the housing crash, he’s now sounding alarms on market froth, leverage, or whatever risk Wall Street is ignoring this time. He’s not always right, but he plays an important role: the guy who forces everyone to double-check the smoke alarms when markets get too comfortable. Michael Burry is also calling AI the next bubble and backing it up by buying millions in puts on Palantir and Nvidia. Just this past week, Burry shutdown his hedge fund, Scion Asset Management. When Burry talks, smart investors at least raise an eyebrow.

JPMorgan on AI – “Productivity’s New Power Tool”

At CNBC’s Delivering Alpha conference, JPMorgan Asset & Wealth Management CEO Mary Callahan Erdoes delivered a simple message: AI isn’t a bubble – It’s a runway. While investors keep flinching at the wild swings in Nvidia, AMD, and the whole AI trade, Erdoes argues the market still hasn’t priced in what AI will do to actual business operations suggesting that we’re early, “precipice” early, in a transformation that will hit corporate revenues and expenses suddenly, the same way Hemingway described going bankrupt “slowly, then all at once”. In her view, the real disconnect isn’t valuations, it is how little of AI’s impact has actually hit company bottom lines.

Ares Management CEO Michael Arougheti backed her up, saying AI investment today is tiny compared to the demand and economic upside ahead. Supply can’t ramp fast enough, and the numbers look oversized only because the opportunity is genuinely that massive. Both leaders also threw cold water on recession calls, noting five years of false alarms. With no downturn in sight, Erdoes says credit investors should be leaning in, not hiding, because this part of the cycle is where smart money quietly loads up.

Did You Know?

Sift Stack Flashback: Amazon vs Walgreens - “Short Heard Around Healthcare”

Did you know that on November 17, 2020, shares of Walgreens Boots Alliance (WBA) fell more than 11% in pre-market trading after Amazon Pharmacy launched its pharmacy service, prompting investor concern that Amazon’s entry could disrupt Walgreens’ business model.

Poll Question

$2k Tariff Checks or Cap?What should the government do with the projected $300 billon in 2025 tariff revenue? |

Last week’s poll results - Who bears the most responsibility for the government shutdown?

47% voted Republican Party

32% voted Both Sides Equally

16% Voted Democrat Party

5% Voted Neither Side, It Is Beyond Politics

Response from one of our followers to last week’s poll question:

“I am trying to understand why the Democrats are dying on the hill about keeping the Affordable Care Act in place. Let's be completely honest that this bill has some major flaws and it is not keeping healthcare costs down. Why should the government subsidize costs? Doesn't that tell you that the system is broken?”

Quote Of The Week

“Smart people focus on the right things.”

-Nvidia CEO, Jensen Huang

Feel free send feedback or further input on the poll question to [email protected] or [email protected]. We would love to hear from you!