- Sift Stack

- Posts

- Time's Person of the Year, TSM, iRobot Collapse, & The "Two Kevins": The Weekly Sift Stack - 12.15.2025 (Issue 7)

Time's Person of the Year, TSM, iRobot Collapse, & The "Two Kevins": The Weekly Sift Stack - 12.15.2025 (Issue 7)

Summary: Welcome back to the Weekly Sift Stack, where Tyler Sherven and CJ Gettelfinger break down the biggest stories moving the markets.

This material is for educational purposes only and is not intended to provide specific investment advice or recommendations. Investing involves risk, including loss of principal. Any forward-looking statements or expectations regarding company earnings are based on publicly available analyst estimates and are not predictions or guarantees of future performance.

To access all social media links, please scroll to the bottom.

Index Tracker Year To Date: 12/12/2025 Market Close

S&P 500 TR: 17.51%

NASDAQ: 20.12%

Russell 2000 TR: 15.85%

MSCI International EAFE TR: 29.47%

Bloomberg US Aggregate Bond Index: 6.73%

10-Year Treasury Yield: 4.186%

30-year Mortgage Rate: 6.22%

Gold: 66.61%

Bitcoin: (4.27)%

US Dollar Index: (9.3)%

Core Inflation 9.30.2025:

Year Over Year: 2.8%

Month Over Month: 0.2%

Consumer Price Index 9.30.2025:

Year Over Year: 3.0%

Month Over Month: 0.3%

Index Tracker Notes:

The S&P 500 had a slight drawdown last week due to a 2% decrease in the Information Technology sector. In the U.S. small-cap space, companies with less the $2 billion in market cap, there was an increase of more than 1%, as we saw market rotation from large technology companies toward small publicly traded companies and traditional blue chips. Lastly, we saw bond yields tick higher for a 2nd consecutive week with markets having declining expectations of rate cuts next year by the Fed.

Stock of The Week: Taiwan Semiconductor Manufacturing Company Limited (TSM)

We couldn’t stay away for long. After taking a brief break from the mega-cap AI and chip names, we’re back this week spotlighting the second-largest foreign company by market capitalization: Taiwan Semiconductor Manufacturing Company (TSM).

To understand why TSM matters, it helps to know exactly what the company does. TSM is the world’s leading semiconductor manufacturer. If building a computer were an assembly line, TSM is responsible for manufacturing the brain. They don’t design the chips themselves; instead, they manufacture highly advanced CPUs and chips that other companies design and customize for their products. This pure-play foundry model is what makes TSM so critical to the global tech ecosystem.

And that client list reads like a who’s who of modern technology: Apple, Nvidia, AMD, Qualcomm, Broadcom, Intel, Amazon, Google, and Tesla, just to name a few. These are some of the most powerful companies in the world, and they all rely on TSM to bring their silicon ambitions to life.

Demand for chips is at all-time highs, and it’s easy to see why. Semiconductors now power nearly every aspect of modern life, from smartphones and laptops to cars, TVs, medical devices, and home appliances. Chips are no longer optional; they’re essential. At this point, the only question is when TSM starts selling guac and queso to go with all the chips they’re producing.

Finally, no discussion of TSM is complete without addressing geopolitics. Tensions between the U.S. and China, particularly around chips and AI, remain a key risk factor. That backdrop helps explain why the U.S. government has recently poured significant capital into companies like Intel in an effort to boost domestic semiconductor manufacturing.

Bottom line: TSM sits at the crossroads of AI, global supply chains, and geopolitics, making it one of the most important companies to watch in today’s market.

Pictured is Taiwan Semiconductor CEO C.C. Wei

Taiwan Semiconductor (TSM) Key Facts

CEO: C.C. Wei

Founded February 21st, 1987 by Morris Chang

Market Cap: $1.58 Trillion

Sector: Technology - Semiconductors

52-week range: $134.25-$313.98

Morningstar Economic Moat Rating: Wide

PE Ratio: 29.92

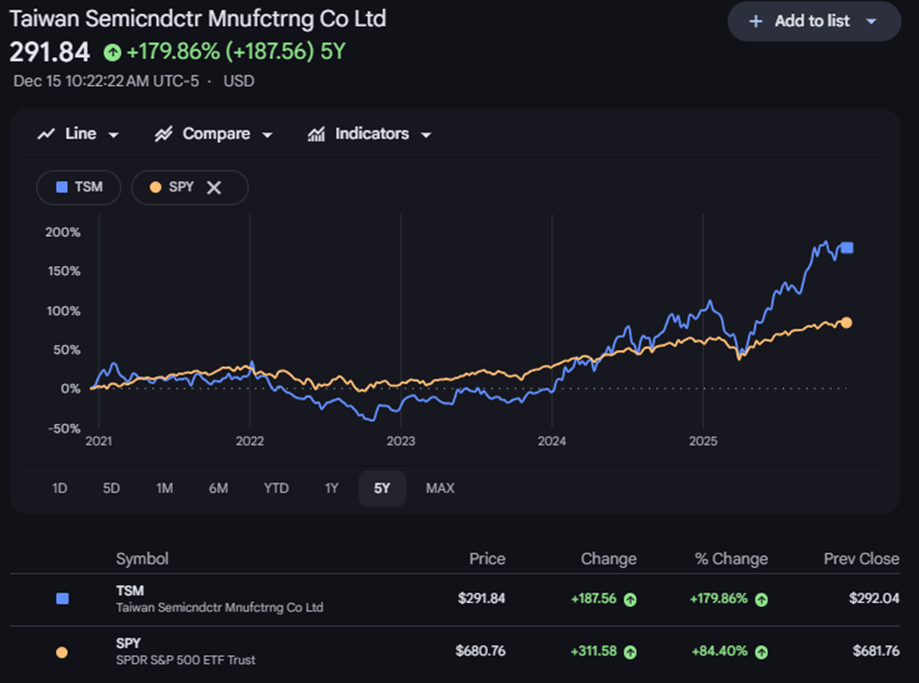

Graph of Taiwan Semiconductor Manufacturing Company Limited (TSM) vs SPDR Shares S&P 500 ETF (SPY) over the past 5-years

Sources: Morningstar & Google Finance

Weekly Insight: The Architects of AI, A Consumer Robotics Collapse, & The Battle Of The Two Kevins

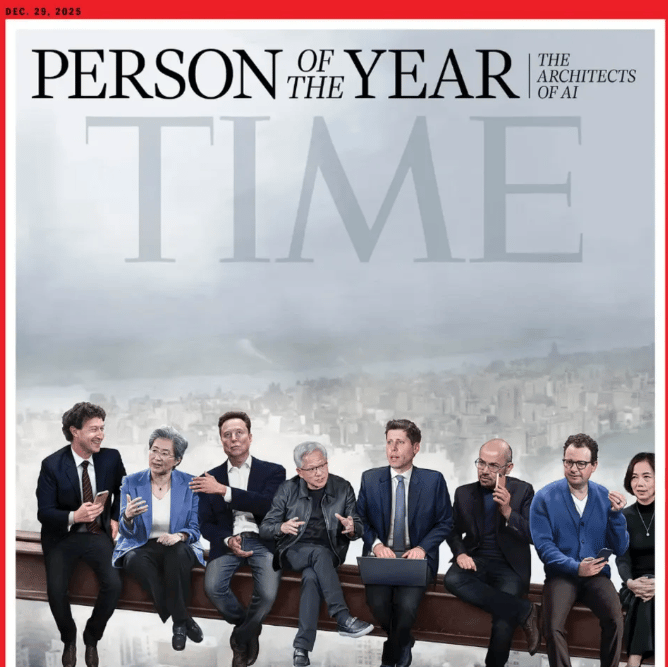

Time Magazine released their 2025 “Person of The Year” cover it is exactly what you thought it would be… “The Architects of AI”

The cover image is not just a single person, it is the architects of AI. Leaders like Jensen Huang, Lisa Su, Mark Zuckerberg, Elon Musk, Sam Altman, and others were recognized for rapidly pushing AI from idea to infrastructure. Time’s message is clear: The AI era has shifted from cautious debate to full-speed deployment - no tapping the brakes, pure gas. AI is now embedded everywhere, reshaping daily life faster than the internet or mobile revolutions, while raising big questions around responsibility, energy use, and jobs.

Roomba Runs Out of Power - iRobot (IRBT) Files for Chapter 11 Bankruptcy

iRobot, the maker of Roomba, filed for Chapter 11 bankruptcy after years of mounting losses, falling sales, and rising costs. The collapse was accelerated by tariffs, which sharply increased manufacturing expenses on products made in Vietnam, while U.S. sales plunged. 2 years previously, Amazon attempted to acquire the company but was disapproved by regulators. With cash dwindling and debt piling up, shareholders are expected to be wiped out. iRobot plans to continue operating during restructuring and expects to be acquired by its primary manufacturer, Picea Robotics, marking a dramatic fall for a once-dominant consumer robotics brand.

Fed Watch - The Battle Of The Two Kevins

Former Fed Governor Kevin Warsh has emerged as a top contender to succeed Jerome Powell as Federal Reserve Chair. Trump told the Wall Street Journal that Warsh and National Economic Council Director Kevin Hassett are leading candidates, calling them the “two Kevins.” Trump also reiterates his view that the Fed chair should consult the president on interest rate decisions, saying his perspective should be considered.

Kevin Warsh leads the way on both Polymarket and Kalshi with 46% and 51% odds respectively.

Odds of the Fed keeping interest rates the same for the upcoming Federal Open Market Committee on 1/28/2026 are at 76% according to CME Fed Watch.

Pictured is Kevin Warsh and Kevin Hassett

Did You Know?

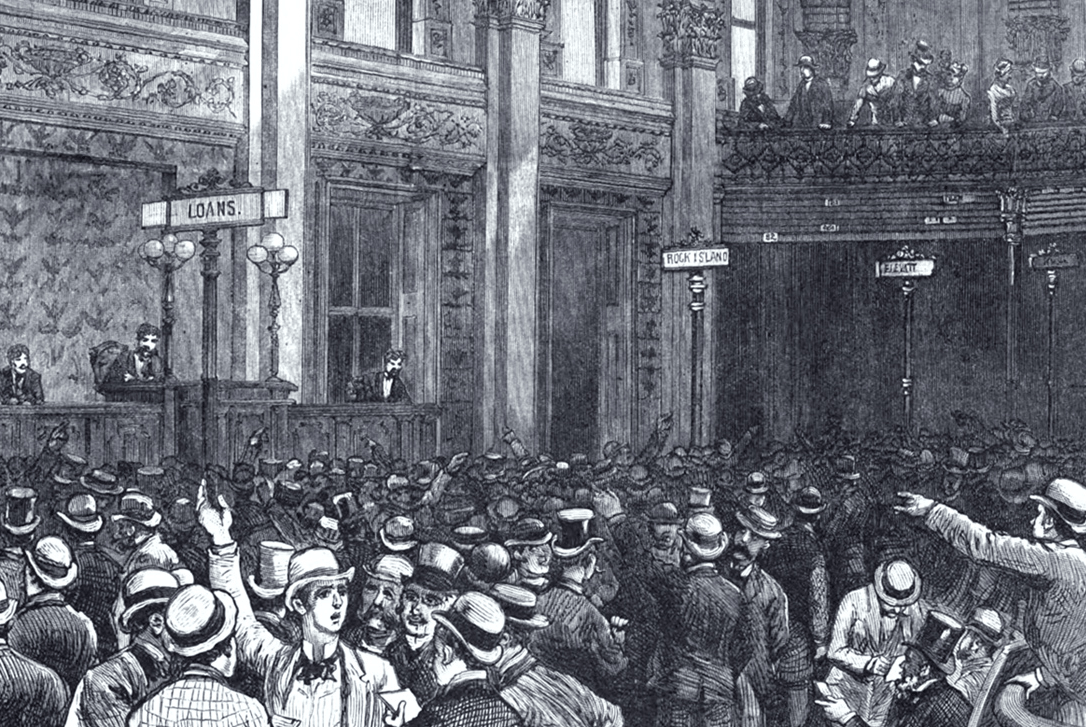

Sift Stack Flashback: “The First 1 Million Shares Trading day of the New York Stock Exchange”

On December 15th, 1886, the New York Stock Exchange (NYSE) recorded its first trading day with volume topping 1 million shares, marking a key milestone in market activity and liquidity expansion.

Poll Question

Of the AI power players crowned by TIME Magzine’s 2025 “Architects of AI” Person Of The Year, who is most likely to dominate the AI landscape a decade from now? |

Last week’s poll results - “Does Netflix’s potential acquisition of Warner Brothers bode well for the stock price?”

82% Voted - Yes, I’m feeling positive about the company

18% Voted - No, hopefully they won’t ruin my favorite films

Pictured is Netflix CEO Ted Sarandos and Paramount CEO David Ellison

Quote Of The Week

“Without strategy, execution is aimless. Without execution, strategy is useless.”

-Taiwan Semiconductor CEO, C.C. Wei

Feel free send feedback or further input on the poll question to [email protected] or [email protected]. We would love to hear from you!